Born Into Luxury

Sabrina wasn’t born into luxury. She once believed living affordably would be simple, but that changed when she mirrored her parents' spending habits.

What she didn’t realize then was that times were different. Managing money seemed easier for her parents, but they didn’t set the best example for her to follow.

Facing Realities

As she stepped into adulthood and faced the realities of budgeting for her future, she realized the weight of her past mistakes. The carefree days were gone, replaced by the sobering truth of financial responsibility.

Despite being caught off guard by how challenging it was to navigate life in the modern world, she refused to let it hold her back. Determined to break the cycle many others simply accept, she resolved to take control of her future—no matter how hard the path ahead seemed.

Struggling To Budget

Sabrina noticed that many people her age were struggling to budget and save for the future. It was a wake-up call, making her realize how easily financial planning could be overlooked.

Determined not to work every day until the end of her life, she set her sights on something bigger. Sabrina dreamed of retiring comfortably — and even more than that, finding a way to work less while earning more.

Challenges And Lessons

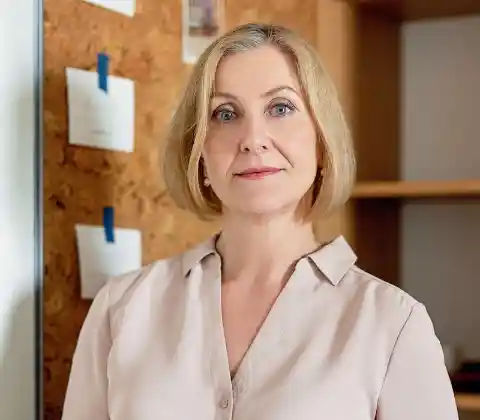

After years of challenges and lessons, Sabrina finally discovered the secret to living life on her terms. Now, at 35, the experiences of the past decade have shaped her approach to balance and fulfillment.

Not only has she secured her retirement, but she also enjoys a lifestyle that many dream of—working just seven and a half hours a week, far less than most people her age.

Under Wraps

Sabrina isn’t one to keep her lifestyle under wraps—she’s more than willing to share her secrets. Surprisingly, they’re simpler than most people expect.

However, it hasn’t been without sacrifice. To maintain her way of life, Sabrina had to let go of a habit that many find hard to break—one that can easily become an addiction people struggle to leave behind.

An Ordinary Girl

Sabrina Ackerman saw herself as an ordinary girl, sharing the same hopes and dreams as most people in Brooklyn. Her parents, born in the sixties, always appeared financially stable, never showing signs of struggle.

Growing up in that environment, Sabrina unknowingly picked up poor spending habits. It wasn’t something she realized at the time, but breaking free from those patterns would prove to be a challenging journey.

Different Generations

“It was a different generation,” they often say when Sabrina asks about Boomers and Gen X. But for her, it feels more personal than just a generational gap.

Her parents regularly went out, spending freely at parties and dinners. Their habits didn’t stop there — at home, their spending was just as reckless.

Cut Corners

Sabrina's parents were never ones to cut corners when it came to their home lifestyle. She recalls her father regularly upgrading his German sports car, always trading it in for the latest model every few years.

At home, her mother spared no expense when it came to furnishing their space, filling it with high-end, antique pieces. And that was just the beginning—technology in their home was always top-of-the-line.

Beyond Luxury Cars

Her father’s generosity extended beyond luxury cars. He ensured their living room was equipped with the latest TV and a high-end hi-fi system complete with large speakers.

She, too, was spoiled with everything she desired—expensive Barbie houses and Easy-Bake ovens. It seemed like money was abundant, but in hindsight, that belief proved to be a misconception.

Luxurious Lifestyle

Sabrina often attributed their luxurious lifestyle to the state of the economy. Despite this, her parents didn’t have extraordinary jobs—both held typical middle-class positions in corporations that offered full benefits.

This reality frustrated Sabrina. She couldn’t deny that life seemed easier than it had been for the previous generation, but she was determined not to simply settle for the status quo.

A Realization

Sabrina was so sick and tired of her mediocre lifestyle. In her twenties, she completely imitated her parents, going to parties every weekend and spending a few hundred dollars.

But when she realized she couldn't do those things and set up a future for herself, she knew she had to make a change.

Struggling

Sabrina was struggling to make ends meet. She was living but not living comfortably. She had her priorities in the wrong areas and knew she'd have to make some huge changes if she wanted more out of life.

She was enjoying instant gratification in life, but it wouldn't last forever, and she knew it. Her wake-up call came, and she knew she had to try something else.

One Big Step

Sabrina tried taking her lifestyle back a bit and started small changes that affected her in a big way. The first was taking lunch to work rather than ordering out.

The second was cutting back on her social life. She went from going out every weekend to once a month. But there was still one massive step to take.

Rent

It didn't make sense, she had made so many sacrifices to save money where she could, but it didn't feel like she was being rewarded. That's when she realized where most of her money was going.

She realized that once a month, most of her money went to pay for her small apartment that didn't match the price.

The Problem Was Brooklyn

Sabrina realized that the problem wasn't even her apartment. It was Brooklyn. She loved her city but realized that it wasn't affordable to rent there.

Her apartment was $2000 in rent every month. But looking at other listings in other areas, she realized that she could find much better for less.

Making The Change

After looking at her finances, she knew what she had to do. She found a beautiful house in Oregon for a third of what she was paying for her apartment.

She didn't give it a second thought. After a month on the market, she had her apartment sold, and she settled down in Oregon, but that did have one repercussion.

Losing Her Job

The cost of moving to another state wasn't just money. She also lost her job. It was understandable, but that meant she had to find a new one immediately if she wanted to keep an affordable lifestyle.

That's when it dawned on Sabrina. It was a risk, but she didn't want to go back to an office job that barely compensated her for her work.

Taking A Risk

Sabrina decided that she would take the plunge into the world of teaching others what she'd learned from her experience handling money.

She wanted others to be aware of what the previous generations had set the new generation up for - failure. People had to be taught not to look at their parents. But that meant taking a huge risk.

A New Way Of Working

Sabrina had a few contacts in the area and decided to set up her own podcast to warn newer generations about how to spend their money and not make the same mistakes she had made in her twenties.

She knew that if it crashed and burned, she'd have to find an office job that would destroy her soul. Would it work?

Making It Work

After a few weeks of hard work setting up the podcast, Sabrina saw her first check roll in. It wasn't the most amazing salary she had ever seen but compared to the work she had put in, she was happy with it.

She was compensated $30,000 a month for her podcast. But there was something about it that made her smile.

Smile

If anyone else was earning that per month, they would have freaked out. But Sabrina just sat back and smiled at the income she had earned. It would cover the $500 bond on her house and all of her expenses for the month.

But why was she so satisfied? She was about to share the revelation on her next podcast.

Money In The Bank

Sabrina shared the reason why she was happy only earning $3,000 a month. She had something that most people her age didn't, savings tucked away.

It was because of the amount of money she had already managed to save through the last six months of hard work before she moved from Brooklyn.

$470,000

Six months before she resigned from her old job, she put in extra hours and made sure that she didn't have any excess expenses. This meant that she had $400,000 saved up.

She only had to work hard for half a year to make up that money without living the lavish lifestyle she normally had. But she put the savings to good use.

Retirement Money

But that was only part of the reason why she was content with a small income every month. She didn't plan on ever dipping on that $470,000 she had in the bank.

She had long-term plans that she couldn't have dreamed of working in Brooklyn or spending as her parents did. She had another ace up her sleeve.

Working Less

Sabrina's real reason she didn't mind earning only $30,000 a month was because of the hours she put into her podcast. She wasn't working a normal 50-hour work week like most others.

She was putting significantly less time into her job now than she was doing back in Brooklyn. It felt almost like she was partly retired already.

Seven

The magic number for Sabrina was seven. Most people didn't believe her when she told them she only worked a seven-hour work week.

That was one hour every single day. She was live, she did the podcast, and then it was over. She did include a five-minute setup every day, which tallied up to just about a 7.5-hour work week. But that wasn't everything.

A New Mindset

Something that Sabrina teaches on her podcast is how early retirement shouldn't be something people strive for. Early retirement should be a right that every citizen has.

She personally said she wouldn't even mind working a seven-hour work week even into her retirement. She loves working less now, if that means working into her sixties.

New Kind Of Retirement

Sabrina calls it a new type of retirement. She has all the time in the world right now to focus on other things, even if that means that she can't live a lavish lifestyle.

She almost considers herself retired now and said that she wouldn't trade it for anything. After ten years of working towards this, Sabrina deserves what she's found.

Giving To Others

Thankfully, Sabrina doesn't like keeping secrets, and she shares all of her mistakes and how to not follow in her footsteps on her podcast every week.

But Sabrina just hopes that more people her age and even newer generations will learn the importance of money as she did, just without the hassle she went through.

Happy To Help

Sabrina even has a free weekly newsletter and hosts a support group every week. These are things she'd never be able to do if she had a 50-hour work week.

She wants to lay a better path for the next generation so that things can be easier, not harder, for them. Something that the previous generation never did for her.